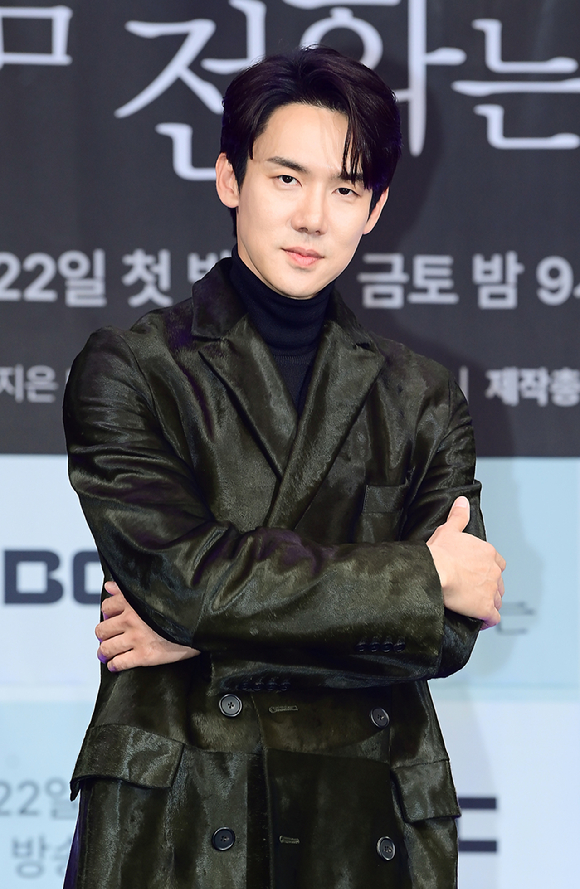

K-actor Yoo Yeon Seok Hit with Largest Ever Tax Audit Owed Amount of 7 Billon Won

Well this is becoming a case of which star can top the next tax audit bill for unpaid amounts in South Korea. Last month Honey Lee was hit with a 6 billion won of owed taxes after an audit that started with her agency, and not a month later we have Yoo Yeon Seok topping that amount with a 7 billion won ($4.8 million USD) bill from the tax authorities. Like Honey Lee’s case, his agency is claiming this amount is simply due to a routine audit and a disagreement with the way his accountant calculated the taxes and the government, but he will be paying the owed amount regardless. Both stars take the same stance that there was no tax evasion, just owed taxes after an audit. Bummer for both as each has been having good years recently with hit projects and for Honey Lee lots of awards too, this will take the luster off as K-netizens have a strong dislike of stars who make a ton of money but don’t pay their owed taxes.

Recent Posts

Chen Zhe Yuan in Talks for Director Guo Jingming’s Next Period C-drama Inferno of Wings

So this feels like a perfect match to me, and one that feels inevitable. Director…

C-actress Zhang Jing Yi Reportedly Cast as Female Lead in High Profile Xianxia C-drama A Beautiful Destiny

So this is the C-drama that last week was rumored to possibly be considering Zhao…

Chen Du Ling and Zhou Yi Ran Cast in Period C-drama Adapted From the Novel Empress Chu

So there was a lot of movement around this drama which has been in prep…

Joo Ji Hoon and Kim Tae Ri Wins Television Category Best Acting Awards at the 2025 Baeksang with When Life Gives You Tangerines Taking Home Best Drama

So this is both a surprise and not a surprise, I think anyone of the…

Married TW- stars Tiffany Ann Hsu and Roy Qiu Confirm They Are Expecting First Baby

Awwwww, what fantastic news to share! Married TW-stars Roy Qiu and Tiffany Ann Hsu announced…

New Stills for jTBC’s Good Boy with Park Bo Gum and Kim So Hyun as Drama Gets Wider Streaming Release

There is a first for everything and it looks like Good Boy is indeed the…

View Comments

Since a few years many celebrities went through a audit , all said the same . If they pay , i don't see the issue . Lee Min Ho, Song Hye Kyo,...and the last one i think is Lee Jun ki . But the fact that many of them have unpaid taxe amounts , probably will increase the number of audits in K celebrity's world which seems to be unable to find good accountants !

I agree. All these celebrities paid up without any sort of complaint. And rich people should be audited regularly since their taxes are likely complicated and more prone to mistakes. I feel like it can't just be rich people getting a tap on the shouldn't that they actually owe more than they've paid.

I knew some celebrities were rich, but it's sort of amazing how he's rich enough to owe 7 billion won in taxes and is like, "sure, I can get that to you right away!"

Lee Jun Ki case is different...His was a technical issue, he does pay all his taxes as he knows.

I wonder if Yoo Yeon Seok will have to be resting for a awhile?

@Hl, i read about LJK and hope that it will go well for him . I don't know about Skorea tax system but in France it's better to pay first and contest after , if they made a mistake they will give you back your money . French actress Isabelle Adjani was in a legal battle about taxes discord and she lost . In France we have so many taxes even without being rich ! But now for the incomes we have a withholding tax system .

YYS case is pretty similar to LJK case actually.

Paid under corporate tax but govt tax agency deemed it should be paid under personal tax.

That 4.8million is back taxes/underpaid for 5 years if not mistaken.

Yooooooo, how much money is he raking in to get a tax bill of $4.8 million?!!!!!

Lol, didn't think he had that many endorsements. Good for him, he needs to get a better accountant though!

I think the issue lay with the interpretation of the tax code. Some of the taxes owed were classified as personal taxes, which carries a higher percentage, while his accountants classified them as corporate taxes as he owns a few companies, and these have a lower tax percentage.

Honestly, this is an understandable dispute as these things are not clear cut. In the US, the tax codes are so complex, they are pages thick! Hopefully he can clear this issue up and come to a resolution. Thankfully , he is not in China, as he would’ve risked being canceled for this.

I never knew that he is that rich. But then I read the article and found out that he owned an entertainment company or something.

Anyway, I don't think that this would be so much of a big deal since it's not tax evasion per se but a dispute over what being imposed as personal and corporate tax, so it's matter of definition. He has submitted request for recalculation back in January and will eventually pay remaining taxes owed once they definition issue but clarified.

Honey Lee been cleared from it so I think the same will apply to him. His new drama been postponed to broadcast in 2026 instead of this year but Idk how this will affect his variety show, Whenever Possible with Yoo Jae Suk.

If he were in China, he would be canceled already. LOL.

Thru cant dispute the amount? Is tax audit always right?

Well the dispute is whether some of his income was personal or corporate/business (his YouTube channel). Discrepancy is that obviously the Tax authorities in Korea thought those moneys were “unpaid” because he didn’t pay it as “YYS” but instead paid it as the corporate entity (moneys earnt from his YouTube channel). He had already paid it via the corporate entity (as per his tax representatives who filed his tax for him) so it’s not like he hasn’t paid it at all. Once they sort out whether he should pay it as YYS or the corporate entity then I am sure he would just pay it.

https://www.soompi.com/article/1729957wpp/yoo-yeon-seoks-agency-addresses-reports-of-tax-investigation

Corporate tax rate is 27% but personal income tax is 45% at the top level. This is what all these recent tax disputes involving actors are about. Actors belong to a major agency, but then set up their own personal agencies/paper companies and have the major agency pay appearance fees and etc. to their own companies instead of their personal bank accounts, so they could use the much lower corporate tax rate. They could also argue that their apartments/houses are headquarters of the personal company/agency and cars and all personal expenses those of the company as well and list these as tax-deductible company expenses. Tax authorities, however, think differently.

Didn't Korea change its tax system and it's why several actors were asked to pay more? Honey Lee but Lee Joon-gi too.