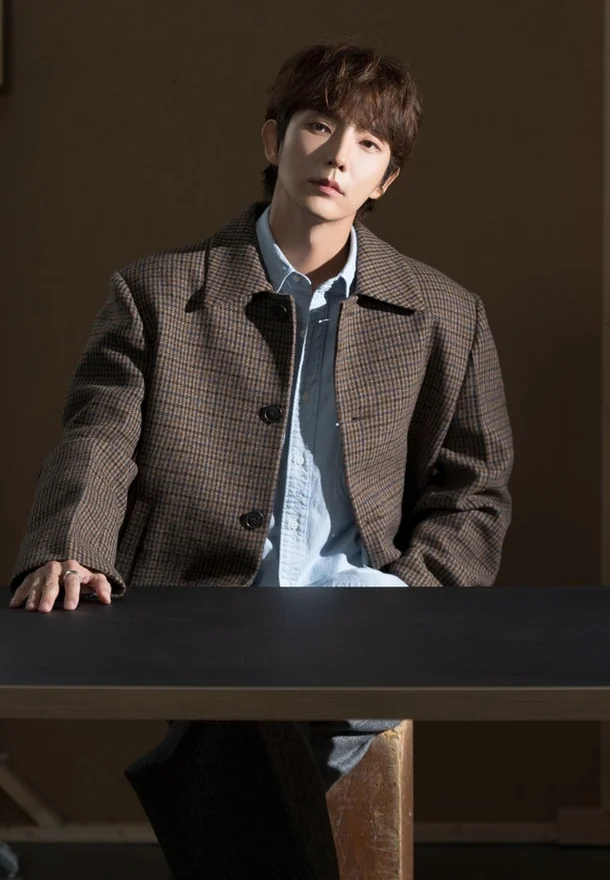

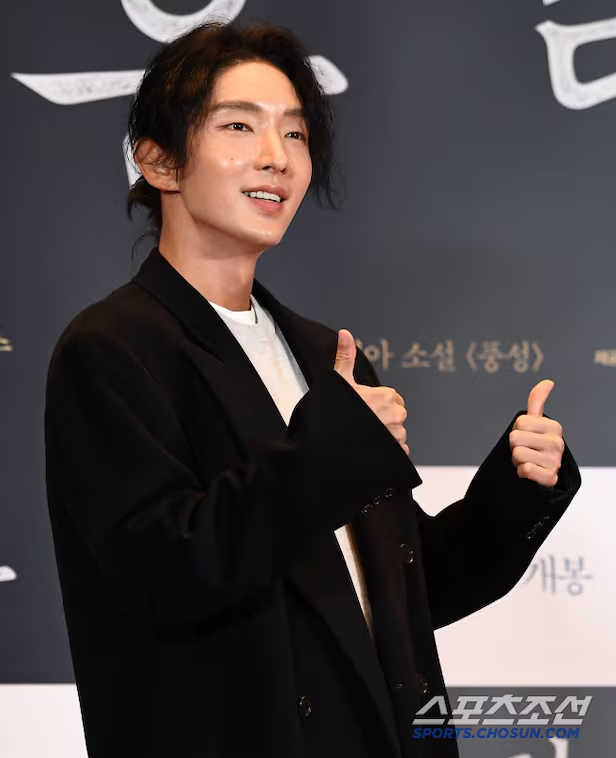

Another Tax Issue as K-actor Lee Jun Ki Hit with 900 Million Won Owed Taxes But He Appeals the Decision

April is tax season here in the US but every month is a possible audit and owed taxes season for anyone especially for the higher earners. Statistics show that high earners are way more likely to be regularly audited and in South Korea it seems to be opens season on entertainers. So far in a month we heard of Honey Lee and Yoo Yeon Seok getting slapped with a hefty bill for owed taxes that the government is taking the position should have been calculated and paid. Add in Lee Jun Ki to this group now as this week he was given a 900 million won ($600K USD) bill for owed taxes so a lot less than the two above but still a big number and also a blemish on his reputation since K-netizens hate stars who don’t pay all their fair share of taxes. Lee Jun Ki’s agency said it’s appealing the decision so let’s see how the government versus his accountant dukes it out in the end.

They doing everything in their power to cover up this issue with KSR and KSH

It has nothing to do with KSR and KSH 🤦

you cant be serious with this…this matter and that matter is totally on different scales.

Today there’s another one with the same issue and it’s Cho Jin Woong.

The loophole in the system causing most celebs and the rich taking advantage by creating paper company to reduce their payable tax. Guess we are going to hear a lot more celebs with tax issue from hereon.

This is technical issue that many celebs are finding themselves in recently. This is not just about 1 person’s action. It is a group of them learning what can and cannot be done. To be honest, I am certain many do not have intention to knowing cheat the Tax offices. Unlike the years China entertainment industry had the Ying Yand contracts. That is really a cheating the Country.

Let’s be honest here. Filling your taxes is complex and HARD. It’s already complex for a nobody like me. I can’t imagine how complex it would be for a celeb with a bunch of different streams of revenue and also pay for their own employees. It’s not like they aren’t reporting where all the income is coming from. It’s just which category they filed it under. If the tax office doesn’t tell you made a mistake the years before how would you know going forward? As long as they are responsive by paying the amount owed or appealing (which is allowed by all citizens), I don’t care.

At least it’s not like c-ent yin yang contracts where they are literally not reporting/hiding a big portion of their income. Even then, I heard the blacklist hammer doesn’t come down unless the celeb continues to ignore the tax notice which I will never understand.

same. I wonder if private accountants – as a whole- have a different understanding of what goes into which category than the ones in the government. Like if an accountant doing a celeb’s taxes weren’t sure about something and asked a large group of industry accountant colleagues, and they all say “yes, x goes into y”, and it became the practice among all the accountants who do celebrity taxes.

Agreed. Tax law is complex. Can’t speak for other countries but in the US, there are often exceptions to tax rules, and even exceptions to exceptions. People find loopholes, and new rules have to be applied or clarified. Then you have the fact that with each new administration, tax laws also can change. These celebrities probably have professionals helping them maximize the amount they keep. This is probably a known loophole the government is cracking down on.

I feel the same. This is likely a loophole Gov is cracking down on. I doubt it affects just celebs, I bet it affects may. But Celebs are the “chicken to kill to frighten the monkeys”.

This is different from China’s Ying Yang contracts which are pure cheating and hiding real payments fees from Tax office. That is unacceptable.

I don’t see any tax disputes between K actors and SK government something worth attention from drama fans. Tax codes in the US are onerous. We used to hire a famous CPA to file taxes for us. But my hubby found mistakes from her filing and caused us to overpay a lot of taxes for years. We filed taxes ourselves afterwards. Even we’re considered financially savvy and meticulous doing all the paper work, we still got corrected by the IRS sometimes, either paid too much or too little. Then we just corrected it. What’s the big deal?

I think other democratic systems are similar. It’s already complicated for lay people to file tax returns if they have various sources of income including salaries, investment, rental income etc., not to mention wealthy people whose financial arrangements are even more complicated.

Tax matters are complex. As long as his complying and filing tax yearly, he’s good.